Eleven Community Banks and Credit Unions Have Joined Forces with Swaystack to Increase Account Activation and Engagement

Swaystack solves the problem we wrestle with every day. We need members to activate their checking accounts and stick around, not just open and disappear.”

MIAMI, FL, UNITED STATES, July 9, 2025 /EINPresswire.com/ -- Swaystack announced today that eleven community banks and credit unions have signed on to its gamified engagement platform in year one. These institutions are turning to Swaystack to solve a growing problem: weak account primacy and shallow new relationships that traditional onboarding methods have failed to fix. This wave of new partnerships signals real momentum and a shift from the old “open an account and hope for the best” approach, as more institutions realize they can’t afford to let new accounts sit idle.— Deb Dietz, CEO of Family Financial Credit Union

Nearly half of newly opened accounts go inactive within the first year. With the cost of acquiring each new account well over $400, a dormant account isn’t just a disappointment; it’s an expensive loss. In the face of these challenges, industry experts warn that banks and credit unions must transform account openings into engaged, long-lasting relationships to secure primary status with customers and members. In other words, simply getting a customer in the door is no longer enough; the objective measure of success is whether that account becomes the customer’s primary financial home.

“Community financial institutions are done accepting a 50/50 chance that a new account will go dormant,” said Har Rai Khalsa, Co-Founder and CEO of Swaystack. “There’s a fundamental shift happening. For years, banks and credit unions poured resources into acquiring new accounts but then largely ignored what came next. That’s changing because doing nothing after onboarding is no longer an option. Leaders now know they have to win the customer’s engagement in the first few weeks or risk losing them entirely, and that urgency is exactly why we’re seeing this momentum.”

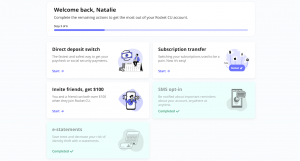

Unlike traditional onboarding tools that take a passive, one-and-done approach, Swaystack replaces passivity with progress. New accounts aren’t just sent a welcome email and left on their own; instead, Swaystack actively guides each account holder through gamified actions inside the institution’s digital banking platform. From the first login, users are prompted to take meaningful steps like funding their account, setting up direct deposit, and using their new debit card. Each step is purposeful, driving behaviors such as account funding and deposit switching right from the start. By focusing on these early actions, Swaystack ensures that a new account quickly becomes a funded, primary relationship.

“Swaystack solves the problem we wrestle with every day. We need members to activate their checking accounts and stick around, not just open and disappear,” said Deb Dietz, CEO of Family Financial Credit Union.

This surge of interest clearly signals the growing urgency across the industry: institutions are no longer content with accounts that remain unfunded or underutilized. These early successes create a practical blueprint for others, demonstrating that stronger member engagement and increased deposits are achievable goals. With momentum building, now is the time for institutions to step forward and confidently secure deeper relationships and measurable growth.

About Swaystack:

Swaystack, a personalized onboarding and engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.1 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built.

Contact Us for Inquiries: https://calendly.com/swaystack/discovery-call

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

YouTube

Intro to Swaystack

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.